1970

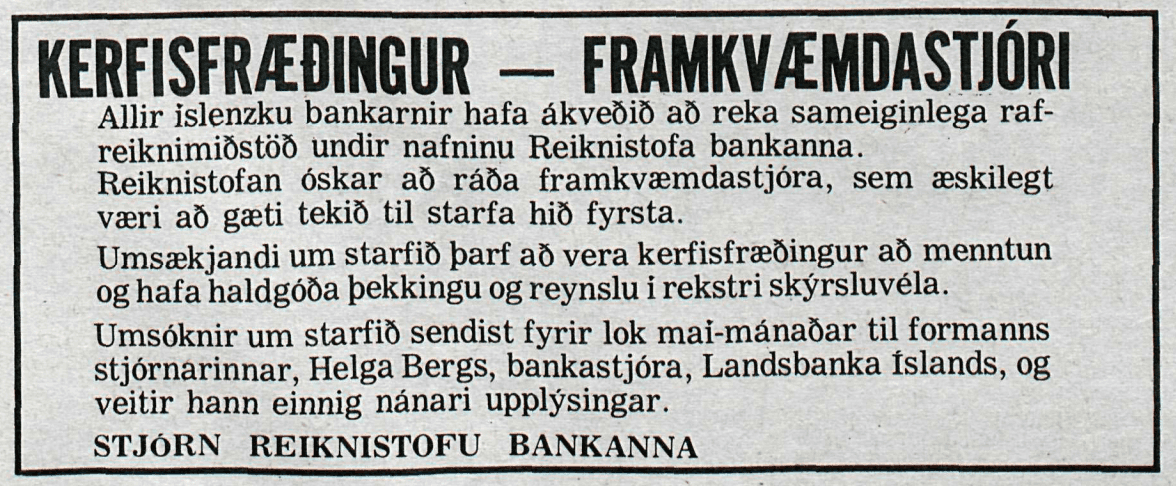

The CEOs of the commercial banks and the Central Bank of Iceland decide to establish an electronic calculations committee. Its purpose was to prepare the foundation of a shared calculation centre for the Icelandic banks. The committee submitted a report in 1971, and the following year, a preparatory committee for the establishment of Reiknistofa bankanna was created.